The Hidden Costs Killing Live Music Festivals: The Insurance Dilemma

Introduction: The Insurance Conundrum in Live Music Festivals

Pill testing at music festivals aims to reduce risks for attendees, but the insurance industry’s stance may paradoxically heighten these risks. The legal liability associated with offering pill-testing services has made it a controversial and expensive endeavor. This article explores the complexities and hidden costs associated with insuring live music festivals, particularly those offering pill testing.

Pill Testing: A Safety Measure or Liability Nightmare?

Pill testing is designed to enhance safety at music festivals by informing attendees about the contents of their drugs. However, the Insurance Council of Australia views it differently. According to Tom Lunn, a senior policy officer at the council, providing such services increases legal liability, despite the good intentions behind them. Alexandra Hordern, the council’s general manager of regulatory and consumer policy, echoed this sentiment, suggesting that pill testing could foster a more permissive safety culture, thereby increasing risks for underwriters.

The Financial Strain on the Live Music Industry

Australia’s live music industry is already under severe pressure from factors like extreme weather and rising touring costs. Events like Splendour in the Grass, once deemed too big to fail, have been canceled. Adding to these challenges, the cost and difficulty of obtaining insurance for pill testing services have become a significant financial burden.

Gino Vumbaca, cofounder of Harm Reduction Australia, expressed frustration with the insurance industry’s stance. Despite providing extensive information about their protocols, insurers remain hesitant. Vumbaca emphasized that pill testing services never guarantee the safety of drug consumption but instead educate users about potential harms.

The Cost of Insurance: A Barrier to Pill Testing

When pill testing trials began at Canberra’s Groovin the Moo festival in 2018, insurance costs were manageable at $7,000. However, by 2022, obtaining coverage became nearly impossible, with quotes ranging from $170,000 to $250,000. Ultimately, a policy costing $80,000 per annum was secured, covering operations nationwide, including future trials in Victoria. This significant increase underscores the insurance industry’s reluctance to cover pill testing services.

Broader Insurance Challenges for the Live Music Sector

The insurance challenges extend beyond pill testing. Small venues and festivals face skyrocketing insurance premiums, sometimes becoming almost impossible to obtain. The ACT government cited a city nightclub whose insurance costs surged from $100,000 in 2019 to $500,000 in 2023. The Australian Small Business and Family Enterprise Ombudsman noted that insurers often apply a one-size-fits-all approach, ignoring the differences between small live music venues and large clubs.

Insurance Companies: Villains or Victims?

It’s easy to paint insurance companies as the villains, but the reality is more complex. The Insurance Council of Australia attributes rising premiums to increasing claims costs, which have risen by an average of 5.5% annually since 2015. The average injury claim in Australia now stands at $130,000, with about 5% of claims exceeding $1 million. Psychological claims, now a significant component of personal injury claims, have further complicated the landscape.

A Call for Reform in Public Liability Insurance

Both the music industry and the insurance sector agree that reform is needed. The Australian Festival Association has long advocated for a government-run or -backed insurance scheme to support festivals. The Insurance Council also calls for a review of civil liability settings to ensure ongoing insurance availability and accessibility. Such reforms could benefit not just the music sector but the broader insurance industry as well.

Conclusion: The Future of Live Music Festivals and Insurance

Rising insurance costs are a critical issue that requires policy intervention for the sustainability of the live music industry. Industry consultant John Wardle highlights the need for this inquiry to develop viable solutions. Whether these solutions will materialize remains to be seen, but addressing the hidden costs and insurance challenges is crucial for the future of live music festivals in Australia.

Related Articles

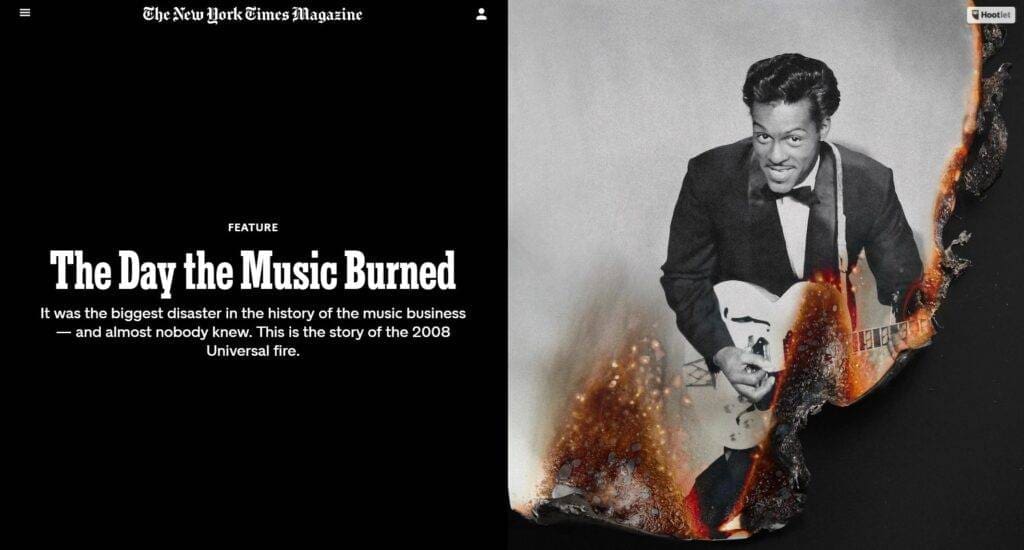

The Day the Music Burned

It was the biggest disaster in the history of the music business — and almost nobody knew. This is the story of the 2008 Universal fire.

Chuck Berry, 1958.CreditCreditPhoto Illustration by Sean Freeman & Eve Steben for The New York Times. Source Photograph: Michael Ochs Archives/Getty Images.

Music Is Facing a Mental Health Crisis

Money is tight while they work long and weird hours, travel incessantly, are isolated from their friends and family at home, and have ample access to drinks and drugs. They write, record, release, and promote, and then repeat the cycle over and over again. And now, more than ever, the industry demands constant content, lest they are forgotten in the ocean of songs hitting Spotify every Friday. But then they get in the van and, especially in Canada, drive absurd distances between low-paying gigs for a tour they likely had to book themselves.

70 Canadian Singers and Bands Who Made It Big in America

Canada is associated with ice hockey, unwavering politeness, and great popular musicians. This is a list to celebrate our fellow Canuk singers and bands who…

15 Best Singers of All Time Some Rock Some NOT

In this article, we embark on a journey to celebrate the timeless talents that have graced the stage and recording studios, revealing the definitive list of the Top 15 Best Singers of All Time.

: “It was an intense process being in this band. By the end, everyone was, like, ‘I don’t need to see you again, ever’”: the rise, fall and spectacular resurrection of Faith No More

It was on a cloudy Friday night in June 2009 when five men in varying states of middle age walked out onto the Download Festival…

Responses